Medium-term Plan

Basic Stance

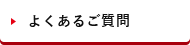

The outlook for the business climate for the financial services sector in Japan is becoming increasingly uncertain. Major causes are structural social changes due to JapanРђЎs declining and aging population, the prolonged period of low interest rates, and the economic downturn triggered by the COVID-19 crisis.

Significantly, the use of digital technologies is increasing at an even faster pace because of this crisis. These technologies are expected to produce dramatic changes in our life styles. Ehime Bank is committed to responding to these changes in order to reinvigorate the economies of its home region.

Long-term Vision

Summary

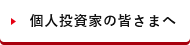

In March 2021, Ehime Bank completed its 16th Medium-term Plan centered on the following theme: Taking on the challenge of innovation and change РђЊ Everything we do is for the benefit of our customers.

Due to actions taken during this plan, deposits and loans increased and there was progress with diversifying securities investments and lowering credit costs. As a result, net income surpassed ┬Ц5 billion in the first two years and is expected to remain above this this level in the planРђЎs final year too. Overall, earnings remained stable despite the challenging business climate.

Ehime Bank is carrying on a tradition of embracing the spirit of Рђюservice to othersРђЮ and Рђюmutual aid.РђЮ In addition, our mission is to support the industries and people in our home region. This dedication to being trusted by customers and playing a role in the advancement of our home region will always be the fundamental component of our management.

We will use the knowledge of everyone at Ehime Bank and take on new challenges in order to adapt to changes in market conditions and meet the diversifying needs of our customers and the communities we serve. The new medium-term plan, which continues to incorporate this basic thinking and the goals of the previous plan, has the theme of РђюThe challenge to enact reforms, second stage РђЊ A platformer for the reinvigoration of our home region.РђЮ To restore the health of our home region from the downturn caused by the COVID-19 crisis, we plan to use new partnerships to implement our РђюFinance Plus OneРђЮ strategy over a large area, while retaining close ties with customers. The objective is to build a distinctive platform and achieve the co-creation of value with our home region.

We are very grateful for the support of our customers, all residents of our home region and our shareholders. We remain firmly dedicated to playing a major role in the advancement of the communities we serve. Backed by the commitment of everyone to РђюThe challenge to enact reforms, second stage РђЊ A platformer for the reinvigoration of our home region,РђЮ Ehime Bank is well positioned for a new stage of progress along with our home region.

The 17th Medium-term Plan (FY2021-FY2023)

The challenge to enact reforms Second stage

A platformer for the reinvigoration of our home region

Our Vision

A large area platform bank based on the co-creation of value with our home region

By using new partnerships to implement our РђюFinance Plus OneРђЮ strategy over a large area, while retaining close ties with customers, we aim to build a distinctive platform and achieve the co-creation of value with our home region.

Fundamental goals

| 1. The РђюFinance Plus OneРђЮ strategy | Maximize earnings by using new partnerships to extend operations to more business domains and take other actions. |

|---|---|

| 2. Efficient operations | Use the control of risk assets to increase the equity ratio, implement low-cost operations to reduce the overhead ratio and take other actions to become more flexible and resilient concerning the many changes in our business climate. |

| 3. A strong foundation | Further upgrade and reinforce compliance, risk management, corporate governance, cyber security, money laundering and other activities. |

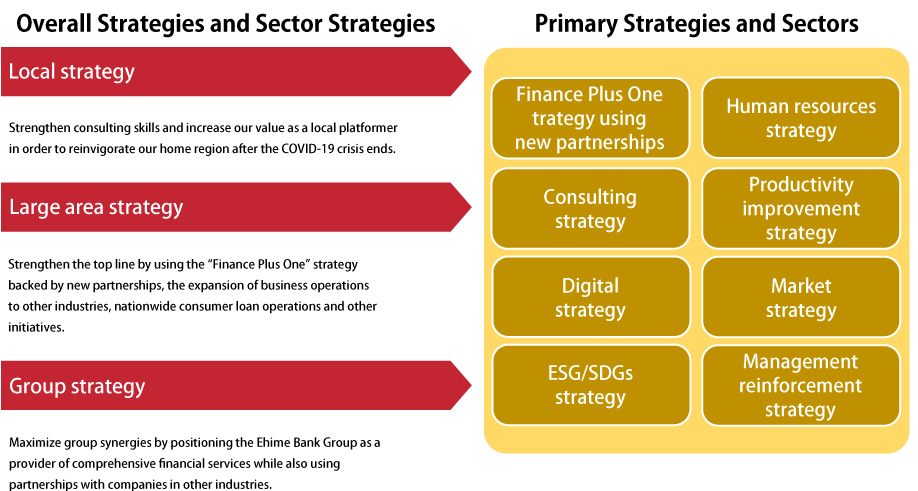

Overall Strategies and Sector Strategies

Primary Strategies and Sectors

Finance Plus One strategy using new partnerships

To be a local platformer in order to reinvigorate our home region, we are using the РђюFinance Plus OneРђЮ strategy with new partnerships to become a source of new solutions that make us an even more valuable provider of support for our customers.

Our goal is to create a next-generation model centered on Ehime Bank as a local platformer in order to manage business risk involving other industries and use activities with other industries to generate earnings. We also aim to build a new loan platform by using new partnerships to provide loans in many areas, expanding consumer loan and other retail banking services to more areas, and taking other actions.

We want to use these initiatives to raise the gross domestic product of Ehime prefecture to 1% of the total for Japan and raise this prefectureРђЎs real economic growth rate and per capita income to more than the average for Japan.

Consulting strategy

To restore the health of our home region from the downturn caused by the COVID-19 crisis, we will strengthen our consulting skills for assisting individual and corporate customers.

For individuals, we will be a source of a variety of asset management products for long-term investments, risk reduction through time and asset diversification and other goals. This will allow us to serve customers as they move do different stages of their lives. Our plans also include strengthening our ability to provide customers with proposals for auto loans, home loans, education loans and other types of loans. Furthermore, we will enhance skills involving services for seniors concerning retirement income, dealing with dementia and other issues.

For companies, our main goal is the creation of corporate value. We use an assessment of the viability of our customersРђЎ business activities to identify issues and needs and start providing consulting services. To ensure that our consulting matches each customerРђЎs requirements, we use cooperation among Ehime Bank Group companies as well as partners outside the group to be a one-stop source of all necessary solutions.

Digital strategy

We will develop and use the advanced digital technologies for the purpose of ensuring that our individual and corporate customers can utilize our products and services with ease at any time and any place. Supplying products and services that match customersРђЎ needs by using the best possible interaction timing is our primary objective. To accomplish this, we use marketing analysis based on the customer experience as the basis for developing innovative technologies.

We want to be a bank that individuals know they can utilize with convenience and confidence. This is why we plan to continue upgrading and expanding the functions of the Ehime Bank app. For companies, we plan to establish a portal site for businesses by the fiscal year ending in March 2023 in order to open digital offices for serving businesses.

ESG/SDGs strategy

Our strategy for the environment, society and governance and for the Sustainable Development Goals includes the goal of becoming the leading company in our home region regarding contributions to achieving the SDGs.

We plan to provide a variety of support that will be divided into three stages: hop (learn about ESG and the SDGs); step (incorporate ESG and the SDGs in our management); and jump (take actions based on ESG and the SDGs). For example, our plans include issuing bonds with an SDG contribution and holding SDG seminars during the hop stage and starting a support service for SDG management during the step stage. Our plans for the jump stage include creating proposals concerning ESG/SDG subsidies and support businesses and assistance for acquiring third-party ESG/SDG certifications.

We plan to institute a governance system, implement scenario analysis, develop management strategies, assess risk management processes, set management targets, and take other necessary actions to proactively respond to TCFD (Task Force on Climate-related Financial Information Disclosure)

Human resources strategy

We plan to use numerous measures to establish a workplace environment where a diverse range of people can realize their full potential. These activities will be centered on four themes: education and training programs, empowering women, health management, and working style reforms. Most significantly, we will use our role as a local platformer to focus on giving people skills to be Рђюlocal producers*РђЮ capable of helping energize communities and areas in our home region.

*Local producers have specialized skills for the use of Ehime BankРђЎs platform in order to play a role in energizing communities and other areas.

Productivity improvement strategy

As our digital technology creates new places for customer interaction, we will revamp our network of branches and offices to establish a large area network. One step is closing or consolidating high-cost locations while increasing the number of Рђюsmart officesРђЮ that have streamlined operations and serve primarily individuals. Space that we no longer need due to this process will be converted into places for community development activities. This realigned network and community space will enable us to perform our role as a local platformer.

In addition, we have established the goal of lowering head office personnel by about 20% by using the digital transformation to improve efficiency and realigning the head office organization.

Market strategy

One result of our dedication to invigorating the economy of our home region as a bank with deep roots in its home region has been the steady growth of our deposits. This is why we are positioning a market strategy, which covers activities like securities investments and syndicated loans, as a key component of our medium-term plan. Our plan is to use our sound base in Ehime prefecture for procuring funds in order to maintain and increase income from securities and other investments. We will use this income to fund expenditures for growth.

Management reinforcement strategy

Conventional integrated risk management has the basic goal of increasing short-term income by adopting the stance that risk should be avoided. However, this approach can result in missed opportunities to earn profits. Activities to secure consistent sources of income are insufficient as well. To invigorate the communities that we serve, we will alter our stance to accept risk based on the proper recognition of risk and the ability to preserve financial soundness. Our goal is to incorporate a risk appetite framework (RAF) in our management with the aim of increasing sustainable sources of income.

Major Numerical Goals (FY2023)

| Profitability | Net Income | More than ┬Ц5,000 million |

|---|---|---|

| Core Net Business Income | More than ┬Ц2,820 million | |

| Overhead ratio (operating expenses divided by core net business income) | Less than 73% | |

| Soundness | Capital adequacy ratio | More than 8% |

| Nonperforming loan ratio | 1% level | |

| Safety | Deposits | More than ┬Ц2,500 billion |

| Loans | More than ┬Ц1,850 billion |

Core net business income = Net business income + Provision for ordinary allowance for loan losses РђЊ Bond-related income/loss

Overhead ratio = Operating expenses/Core gross business income

Capital adequacy ratio = Equity/Risk assets

Nonperforming loan ratio = Nonperforming loans/(Total loans + Guarantees and other claims)