Business overview №╝ѕNon-Consolidated ,JGAAP№╝Ѕ

Financial Highlights(Non-Consolidated)

№╝ѕunit№╝џmillion yen№╝Ѕ

| 2021.3 | 2022.3 | 2023.3 | 2024.3 | 2025.3 | |

|---|---|---|---|---|---|

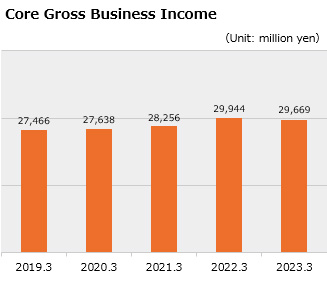

| Core Gross Business Income | 28,256 | 29,944 | 29,669 | 27,309 | 27,882 |

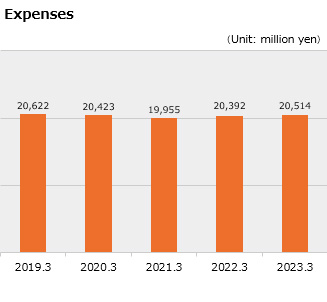

| Expenses | 19,955 | 20,392 | 20,514 | 20,742 | 21,270 |

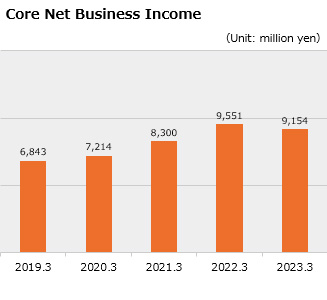

| Core Net Business Income | 8,300 | 9,551 | 9,154 | 6,567 | 6,611 |

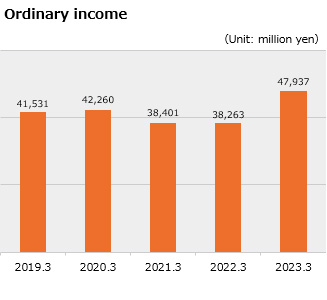

| Ordinary income | 38,401 | 38,263 | 47,937 | 60,558 | 60,986 |

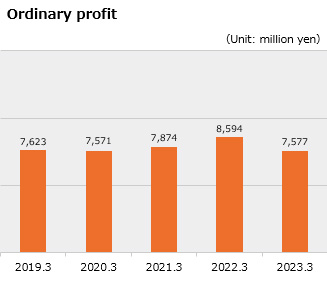

| Ordinary profit | 7,874 | 8,594 | 7,577 | 7,080 | 7,084 |

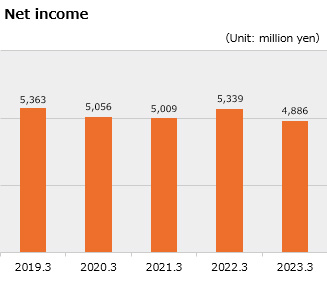

| Net income | 5,009 | 5,339 | 4,886 | 4,509 | 5,216 |

Financial Data(Non-Consolidated)

№╝ѕunit№╝џmillion yen№╝Ѕ

| 2021.3 | 2022.3 | 2023.3 | 2024.3 | 2025.3 | |

|---|---|---|---|---|---|

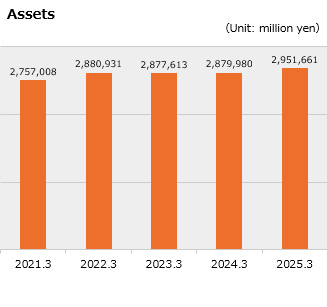

| Assets | 2,757,008 | 2,880,931 | 2,877,613 | 2,879,980 | 2,951,661 |

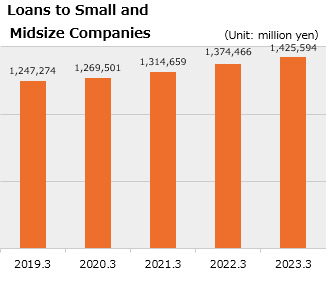

| Loans to Small and Midsize Companies | 1,314,659 | 1,374,466 | 1,425,594 | 1,448,069 | 1,454,088 |

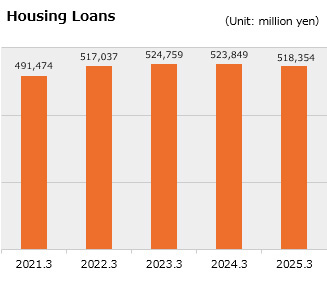

| Housing Loans | 491,474 | 517,037 | 524,759 | 523,849 | 518,354 |

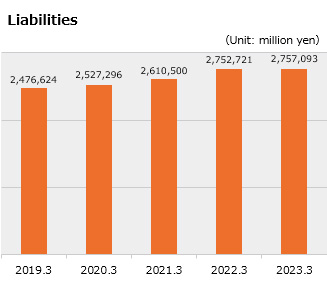

| Liabilities | 2,610,500 | 2,752,721 | 2,757,093 | 2,750,538 | 2,824,334 |

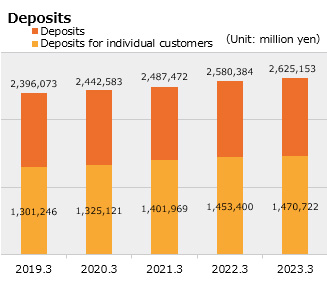

| Deposits | 2,487,472 | 2,580,384 | 2,625,153 | 2,650,772 | 2,707,932 |

| Deposits for individual customers | 1,401,969 | 1,453,400 | 1,470,722 | 1,475,982 | 1,483,268 |

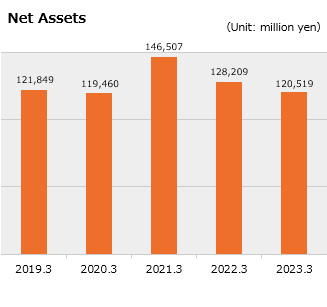

| Net Assets | 146,507 | 128,209 | 120,519 | 129,441 | 127,326 |

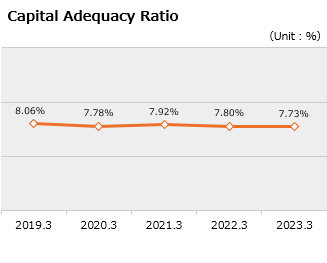

Management Indices(Non-Consolidated)

| 2021.3 | 2022.3 | 2023.3 | 2024.3 | 2025.3 | |

|---|---|---|---|---|---|

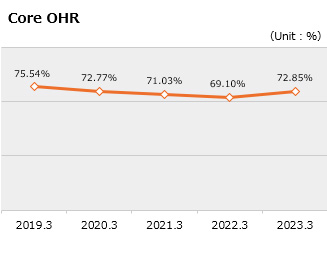

| Core OHR | 70.62% | 68.10% | 69.14% | 75.95% | 76.29% |

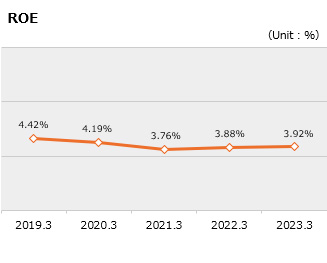

| ROE | 3.76% | 3.88% | 3.92% | 3.60% | 4.06% |

| Capital Adequacy Ratio | 7.92% | 7.80% | 7.73% | 7.77% | 8.10% |

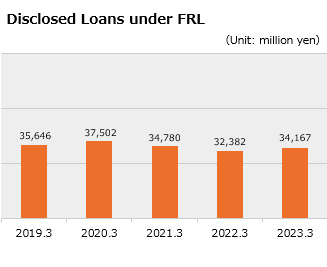

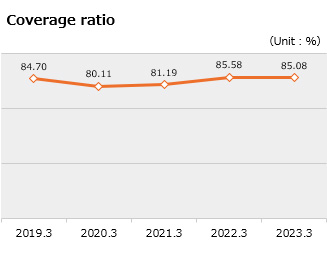

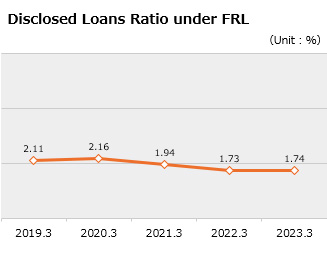

Nonperforming Loan (non-consolidated)

№╝ѕunit№╝џmillion yen№╝Ѕ

| 2021.3 | 2022.3 | 2023.3 | 2024.3 | 2025.3 | |

|---|---|---|---|---|---|

| Disclosed Loans under FRL | 34,780 | 32,382 | 34,167 | 39,141 | 34,851 |

| Coverage ratio | 81.19% | 85.58% | 85.08% | 82.25% | 77.07% |

| Disclosed Loans Ratio under FRL | 1.94% | 1.73% | 1.74% | 1.98% | 1.73% |

FRL : the Financial Reconstruction Law