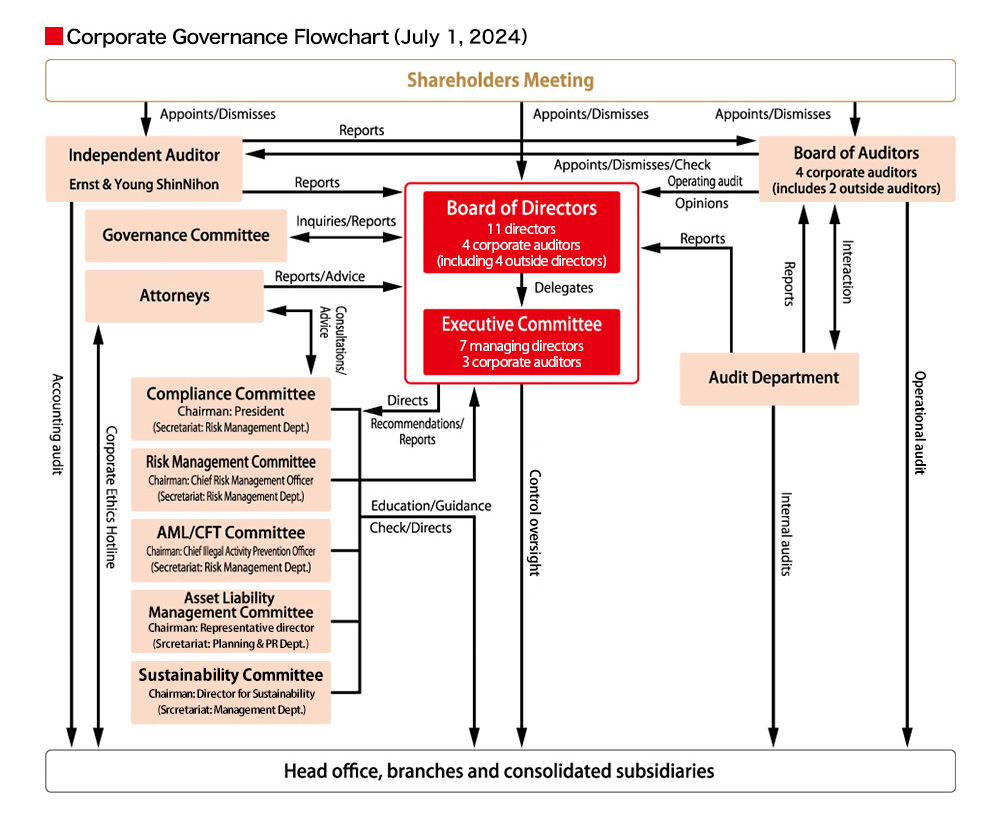

Corporate Governance Framework

Management transparency and the maximization of corporate value are the goals of corporate governance at the Ehime Bank. Our basic policy is to use the following measures in order to build and strengthen our organizational structure so that we can respond swiftly to changes in the business climate.

The Board of Directors has 11 members, including 4 outside directors. Outside directors are designated as independent directors.

The Ehime Bank uses the corporate auditor system. The Board of Auditors has four members, including two outside auditors. Corporate auditors attend meetings of the Board of Directors and the full-time corporate auditors attend meetings of the Executive Committee in order to ensure that the individuals at these meetings are performing their duties properly.

For business operations, there is also a Compliance Committee, Risk Management Committee and other committees. Individuals involved with internal audits attend these committee meetings to perform oversight.

Board of Directors

As a rule, the Board of Directors meets once each month in order to make decisions about important matters and oversee the execution of business operations. There is also an Executive Committee consisting primarily of directors who are also the Ehime Bank Group executives for the purpose of speeding up decisions and conducting business operations more efficiently in accordance with the basic policies determined by the Board of Directors. As a rule, the Executive Committee meets once each week for important matters involving business operations.

Internal Audits

The Audit Department, which is independent of departments involved with business operations, performs internal audits of the head office, branches and other offices, and consolidated subsidiaries. Results of audits are reported at the Internal Audit Report Conference, which is held, as a rule, once every month and attended by the president of the bank. This conference discusses these reports as well as the current conditions, problems and issues, and other matters involving the units that were audited. The purposes of these activities are to reduced risk exposure, ensure the soundness of clerical tasks and verify that business operations are conducted properly.

External Audits

Thorough external audits are performed by Ernst & Young ShinNihon LLC in accordance with an auditing contract with this firm. Certified public accountants Osamu Yamada and Tsuyoshi Nagasato performed the audit for the financial statements for the fiscal year that ended on March 31, 2024. In addition, 9 certified public accountants and 23 other professionals assisted with the audit. None of these individuals has been involved with the Ehime Bank external audit for more than seven consecutive years. There are measures in place to prevent the same individuals from participating in the financial audit of Ehime Bank for more than a certain number of years.

Corporate Auditors, Audit Department and Independent Auditor

The corporate auditors, Audit Department and independent auditor work closely with each other, including for the sharing of information about the results of audits, in order to perform audits efficiently.

Governance Committee

This committee is an advisory body to the Board of Directors established with the aim of realizing improvement in the corporate value of the Ehime Bank by enhancing the quality of its corporate governance and ensuring the fairness and objectivity of its procedures for the nomination and remuneration for directors, etc. The majority of the members of the committee are outside directors.

Compliance Committee

Compliance is one of the highest priorities regarding the management of the Ehime Bank. This committee, which is chaired by the president, is responsible for maintaining a sound compliance framework. As a rule, the committee meets once each month to examine and discuss problems and other subjects involving compliance. In addition, there is a compliance officer in each department and at each branch in order to ensure strict compliance with laws, regulations and other guidelines.

Risk Management Committee

This committee accurately recognizes and monitors the different types of risk associated with the banking business and properly manages this risk exposure. The objective is to maintain the soundness of business operations and a stable foundation for these operations. The committee, which is chaired by the chief risk management officer, meets once each month, as a rule. Committee members consider and discuss policies and countermeasures for dealing with different categories of risk.

Anti-Money Laundering№╝ЈCountering the Financing of Terrorism Committee

The prevention of money laundering, support for terrorism and other illegal activities is one of the highest priorities regarding the management of the Ehime Bank. This committee confirms that risk identification, assessment and reduction measures are effective. The committee also performs the centralized monitoring, analysis and evaluation of responses to these risks. Committee members also examine and discuss problems involving money laundering and other illegal activities. Chaired by the chief illegal activity prevention officer, this committee meets at least once each month.

Asset Liability Management Committee

This committee analyzes and discusses issues concerning market-related risk factors. Chaired by the director in charge of the Planning and Public Relations Department, the committee meets once each month, as a rule. Submitting advice to the Executive Committee is one more role of this committee.